Although First bank is well known as one of the premier banks in Nigeria, one of the qualities customers love about them is their quick loans. Since its launch bank in 2015, it has incorporated loan services on the FirstMoney app, making it more popular among customers. If you’re in emergency needs, here’s a rundown on how to get a loan with the First bank mobile application.

First Bank app Information

- Version – 2.4.1

- Last Update – 4th of January 2021

- Number of Downloads – 1,000,000+

- Download Size – 43.04MB

- App Provider – First Bank Nigeria

- Release Date – 9th of September 2015

What are the eligibility requirements to obtain a loan from the first bank mobile app?

There are certain qualifications you must meet before being able to obtain a loan from the FirstMoney app. These requirements are:

- This service is only available to customers, therefore must have an account with First Bank Nigeria

- Must be an employee with proof of steady salary income within the last six months

- Your salary account must be domiciled with the bank

What are the features and charges associated with the First bank mobile application loan?

The features associated with the first bank mobile application loan are:

- It has a maximum tenor of 30 days or your next payday

- Management fee of 1% deducted at the point of loan disbursement

- Credit life assurance fee of 0.5% of the value of the loan

- An interest rate of 2.5% flat, which is collected upfront upon loan disbursement

- The loan service is based on an enhanced and modern version of Digital SODA

- Automatic loan repayment deduction as soon as your salary is received

- It is accessible a maximum of 3 times a day, subject to your specific maximum eligible amount

- Automatic risk acceptance criteria

- All fees and deductions are made upfront upon disbursement of the loan

Interesting Read: FirstMonie Loan – How To Borrow A Loan Instantly

How to get a loan with first bank mobile app

Getting a loan with the first bank mobile application is pretty simple. Follow the procedure below:

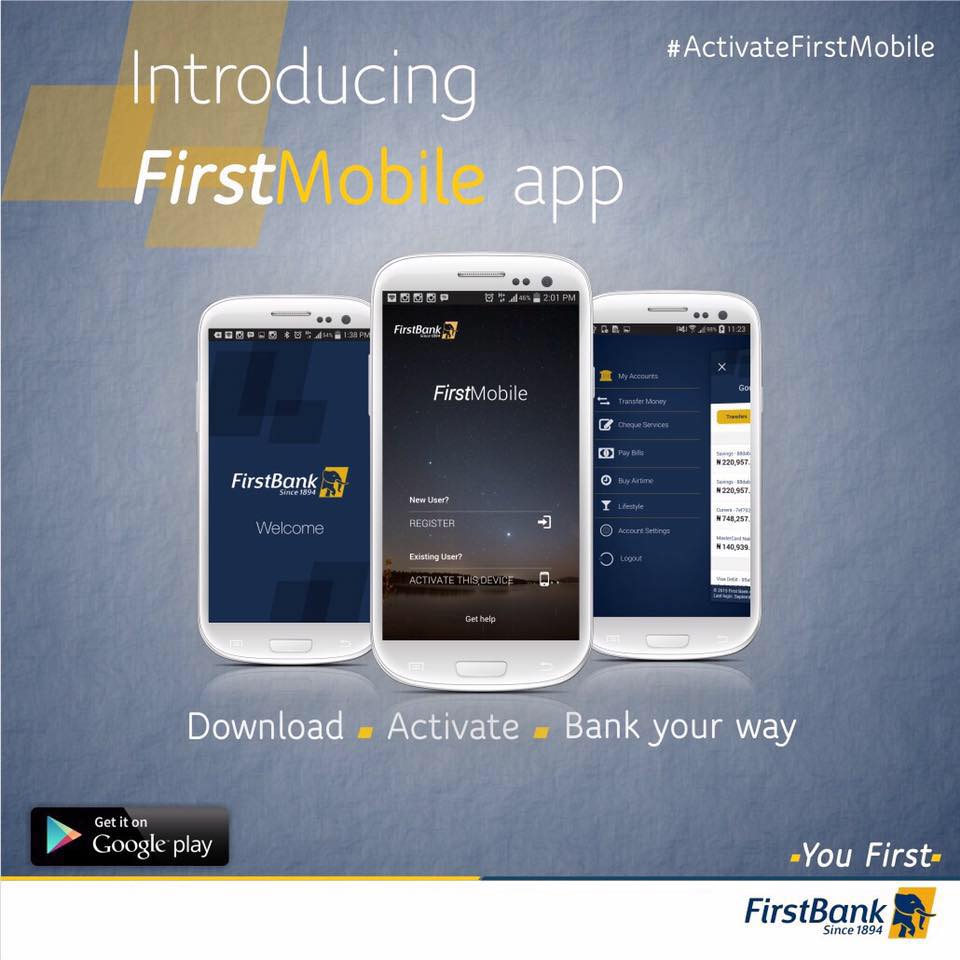

- Download the FirstMobile app from google play or apple store on your mobile device

- Log in with your online banking details

- Open the menu and select loans from the available options

- Select FirstAdvance, after which your eligible maximum amount and applicable pricing fees would be displayed

- Next, if okay with it, click the “Accept the Terms & Conditions” button

- The prompt then displays a dialogue box for you to input your desired loan amount. Also, note that this amount should not be more than your eligible amount

- Input your transaction pin to confirm your application request

- If your loan request is successful, the bank disburses the loan into your salary account in a matter of minutes

- Also, the banks debit you for charges like management fee & VAT, interest rate, insurance, and other applicable deductions.

- Lastly, they deduct the money from your balance in the next 30 days or when you receive your next salary.

Conclusion

The FirstMoney mobile application offers loan services to first bank customers whose salary account are domiciled with the bank. Also, it is easy to use and very user-friendly, therefore patronized by thousands of customers on a daily basis.

Check out the Related Posts below:

- Access bank mobile app - How to get a loan through the app

- To U Loan App - How to borrow money from To U Loan app

- Mint Loan App - How to get a loan from Mint Loan Nigeria

- Streamlining the Loan Journey: How to Reduce…

- How to Link NIN/BVN To Your First Bank Account in 2024

- Zenith Bank Makes History with First Female CEO