Life can be unpredictable, a financial expense that one isn’t prepared for can throw off an individual or even a family off course and sometimes lending from family and friends may not cut it, so what do you do? This is where KwikPay comes in.

How much can I get from Kwikpay?

KwikPay is an online platform where you can get a quick loan in Nigeria. It uses your monthly salary to determine your credibility and approval, and disbursements are sent within minutes and loan amounts range between N10,000 and N2 million naira. This loan can be used to pay for expenses such as school fees, hospital bills, travel etc.

Am I eligible for a Kwikpay loan?

To be approved, the following factors are considered,

- Your monthly salary and

- The length of service (how long you’ve employed for) and the position in your company.

The loan is typically about 50% of your monthly salary and the repayment plan can range between 3 – 6 months.

What are the benefits of KwikPay

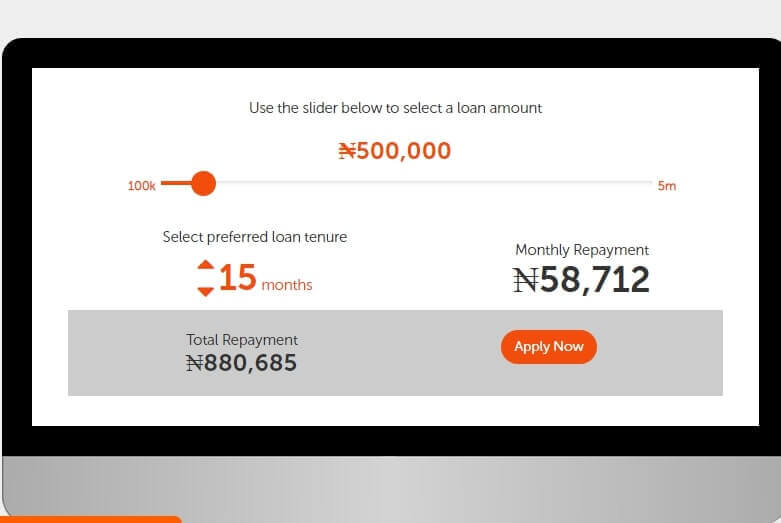

- You can make the decision on the amount you want to lend. So for example, if you get approved for more than you need, you can lower the amount so you won’t be obligated to repay an amount you don’t need.

- You can get approval in minutes which is really helpful in cases of emergency

- You can set up your repayment tenure and the money is sent into your account within minutes

- Your salary is used to determine your loan amount which is done so that you can borrow within your financial limit

- No application fee, no admin fees and collateral are needed.

- There are no hidden fees. Interest rates are communicated upfront.

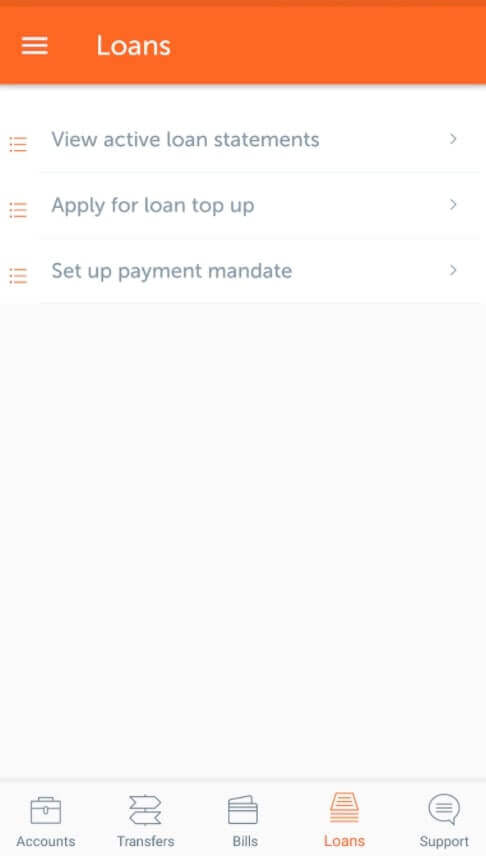

- The repayment process is very easy. The payment is taken directly from your bank on the specified date or by using pre-written and pre-signed checks provided at the time of application. The checks will only be paid in on the date written on the check. Also, a reminder is sent to you via email at least three days before the repayment is due.

How to apply for KwikPay Loan

- Must be over 18, be employed and have a Nigerian bank account

- Online application form

- Completed Employee Status Inquiry or Employer’s Confirmation Form

- Evidence of employment confirmation – Employment contract and/or recent letter of promotion (if applicable) works

- Employment ID and valid means of identification (passport, drivers license, national ID etc.)

- Credit checks (If you’ve taken any loans prior to this at any financial institution in Nigeria, the repayment of these loans are factored in)

- A guarantor may be needed (this is dependent on loan amount)

Conclusion

KwikPay is an easy and available option when unplanned financial commitments occur. The process is available 24/7 online and approval and disbursements are done within minutes.

To get more information about the process and any other questions you may have, you can visit their website at www.kwikpaycredit.com or send an email to them at info@kwikpaycredit.com. Bear in mind that we have agents at loanspot who are also willing to help you through the process. Click here to reach out to us!