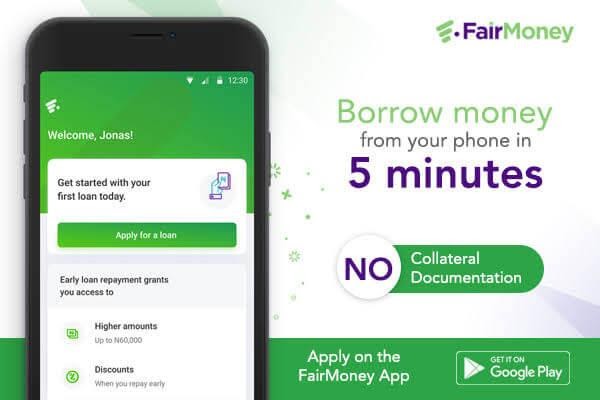

FairMoney is a loan app in Nigeria that offers its users an easy and stress-free way of lending money. They launched FairMoney Loan in early March 2018. The online lending platform disburses over 1,500 loans daily to Nigerians.

Follow the steps below to get a loan from FairMoney:

- Download the Android application from the Google PlayStore.

- Sign up or log in with your phone number or Facebook profile.

- Create a profile of you’re a new user or apply for a loan as an old user.

- Get credited with money in your bank account within a matter of minutes.

An Overview of FairMoney Loan and App

This loan platform provides you with a different way of getting a loan in Nigeria. Also it does this with no collateral. You can get an instant loan of up to as much as ₦500,000 without needing any paperwork or even collateral. This would be done in under five minutes or less.

In addition, the app helps you gain access to critical finance via the power of modern technology. It is fast, reliable, secure, and most of all, free! This makes it one of the best loan apps in Nigeria.

How Much Can I Borrow from FairMoney and for How Long?

You can access a FairMoney Loan in the range of ₦1,500 to ₦500,000 with durations for loans up to 60 days and above. The monthly interest is also about 10%-30% monthly. The process does not incur any additional fees or hidden costs when processing your loan.

There are no requirements for getting a FairMoney loan. Simply sign up on the app and your loan will be processed. This is done without rigorous due processing like documentation and collateral.

Get a loan up to N100,000 at the best affordable rates in Nigeria

Now you can compare interest rates from different lenders with our loan simulator and get the best deal. Making an informed loan decision requires comparing different loan offers before making a commitment. Through our simulator, you can see at a glance, loan offers coming from different lenders in less than 5 minutes, so you can make the right decision regarding your financing. Try it today

What Is the Highest Amount Fairmoney Loans?

FairMoney offers a loan of up to N3,000,000 with a tenor of 24 months. However, note that you do not have access to this amount as a new user. Instead, your limit cap is decided after a credit assessment and increases over time. Basically, the better your lending history and loan repayment behaviour, the more the amount of loan you can access and the longer your repayment period will be.

What Is Fairmoney Interest Rate per Annum?

Generally, Fairmoney Interest rates range from 2.5 to 30% depending on the loan amount and repayment period. Note that the exact interest rate and tenor will be communicated during your loan application process.

If you do not repay at the agreed time, you will be subject to late fees at the discretion of FairMoney, your lending account will also be suspended, and you will be reported to the National Credit Bureau and possibly permanently suspended from lending from other credible lending institutions

What Happens if I Don’t Pay My Fairmoney Loan?

Failing to repay your Fairmoney loan will see the amount subjected to late repayment fees at their discretion. Additionally, your Fairmoney account will be suspended and you will be reported to the national credit bureau. This may lead to suspension across other lending platforms, government loans and credible institutions.

Bottom Line

Fairmoney is a popular loan service provider which has proven to be reliable over the years. You can obtain a loan from the platform by downloading the app and applying today.